The Bank of Cana da cut interest rates by 25 basis points again in July, marking the second consecutive month of easing. The move reflects their response to diminishing inflation risks and growing concerns about our economy.

da cut interest rates by 25 basis points again in July, marking the second consecutive month of easing. The move reflects their response to diminishing inflation risks and growing concerns about our economy.

As someone who’s been closely watching these shifts, I want to break down what this could mean for all of us, especially in the real estate market.

Now, according to economists, recessions are traditionally defined as two straight quarters of negative GDP growth paired with rising unemployment. Right now, the numbers show that Canada is still in positive territory. Our GDP grew at an estimated annualized rate of 2% by the end of the second quarter—while not a stellar performance, it’s still growth. Our unemployment rate, meanwhile, ticked up to 6.4% in June, which is still fairly low by historical standards.

What does this mean? Well, it suggests that the Bank of Canada is making careful, calculated moves with interest rates. The economy hasn’t tipped into recession yet, so they’re keeping the rate adjustments slow and steady. For those of us in real estate, this means we’re not dealing with extreme swings just yet.

But here’s where things get more interesting: when we look at some alternative indicators, a different picture starts to emerge.

A strong case can be made that much of the growth we’ve seen in the past two years is due to record immigration. Since 2022, Canada’s population has grown by an incredible 6%, adding over 2 million new people to the economy. And since consumer spending drives more than half of economic activity, these newcomers are giving our numbers a real boost just by being here and participating in the economy.

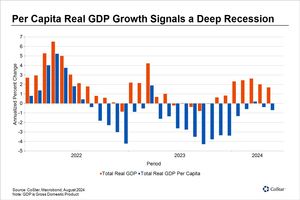

Without this population surge, our economy likely would have shrunk over the last two years. In fact, if we look at per-person data, household spending (adjusted for inflation) is actually down 2.6% from its post-pandemic peak and 2% below pre-pandemic levels. This is a sign that rising prices and interest rates are eating into people’s purchasing power.

Even more concerning, per capita GDP has fallen in six of the last seven quarters, putting us 3.1% below where we were in 2019. This decline suggests that, on an individual level, our standard of living has been gradually eroding.

And let’s not forget about the labor market. Sure, the unemployment rate’s rise by 1.6 percentage points over the past year isn’t as dramatic as in past recessions, but here’s the thing: in the last 50 years, we’ve never seen an increase in unemployment of this magnitude without a recession following soon after.

So, what’s the takeaway here? Technically, Canada isn’t in a recession right now, but the reality is that we’re navigating through a fragile economy that’s being propped up by record-high population growth. If we didn’t have this surge of new arrivals, the story would likely be much bleaker.

The Bank of Canada has even acknowledged that this rapid population growth might be creating more slack in the economy than previously thought, which means there might actually be more room for disinflationary pressures than they’re currently accounting for.

In simpler terms, they could be underestimating how much room they have to cut rates, and we could be seeing more easing in the near future.

For us in the real estate market, this could mean even more favourable conditions ahead, particularly as interest rates move lower. Keeping an eye on these economic trends is crucial for anyone considering buying, selling, or investing in property in the coming months.