Executive Summary

Transaction data from late 2025 through January 2026 reveals a distinct split in the Waterloo Region multi-residential market. While institutional capital has aggressively consolidated large-scale assets in Cambridge and Kitchener, private capital remains highly active in the "missing middle"—specifically targeting value-add assets with significant rental upside.

Based on our review of recent transaction records, here is an analysis of the current market dynamics.

Institutional Capital seeking Scale

The most significant takeaway from the past 12 months is the sheer volume of institutional capital deployed into the region. Major players are not merely testing the waters; they are acquiring entire portfolios to achieve immediate scale if not already in place.

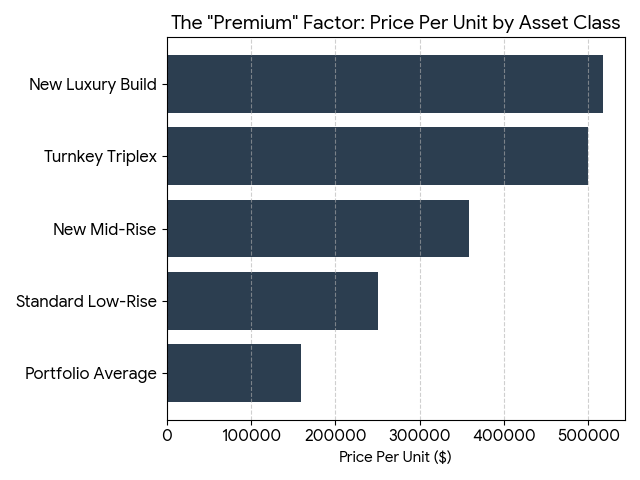

- The Benchmark Transaction: The region recently saw a landmark sale of a newly constructed, 280+ unit luxury complex in Cambridge. This asset commanded a sale price of $517,000 per unit. This underscores the massive premium placed on new-construction, Class A assets sold during the lease-up phase.

- Portfolio Consolidation: We have observed a trend of bulk portfolio sales. For example, one institutional buyer acquired a five-building portfolio in Cambridge totaling nearly 400 units for over $159,000 per unit.

- REIT Activity: Similarly, a private REIT recently expanded its footprint in Kitchener, closing on a two-building portfolio totaling over 150 units for a combined $40 million, reflecting a confident 5.5% Cap Rate on stabilized vintage assets.

Market Insight: These acquisitions align with broader economic data indicating that the Waterloo Region is, or rather was at the time, outpacing major metros like Toronto and Montreal in population growth. Institutional buyers are pricing in this long-term demographic stability.

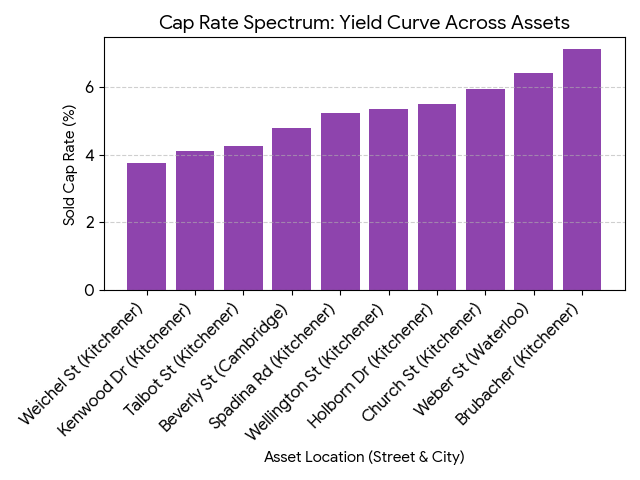

Cap Rate Compression and Asset Divergence

The data indicates a clear spread in Capitalization Rates based on asset vintage and stability. Investors should note that "market cap rate" is no longer a singular metric but is highly dependent on the asset class.

- Class A / New Construction: Recent data shows premium, new-build assets in Waterloo trading at sharp cap rates, often in the 3.15% to 3.5% range, reflecting their lower risk profile and operational efficiencies.

- Stabilized Mid-Market: Well-maintained vintage assets (1960s–1970s construction) are generally trading in the 4.5% to 6.0% range. For instance, a 40-unit building in downtown Kitchener recently traded at a 5.95% Cap Rate ($229,500 per unit).

- Value-Add / Yield Plays: Smaller, older assets offering management upside are seeing higher going-in yields. We observed a 14-unit assembly in Kitchener selling with a reported Cap Rate exceeding 7.0%.

The "Missing Middle": Zoning and Density Plays

Private investors are increasingly targeting properties that offer intensification potential rather than just yield.

- Intensification Potential: One recent transaction involved a 16-unit building in Kitchener that sold for $3.1 million. The key value driver was not just the existing rent roll, but the approval in place to add four net new units by converting lower-level space.

- Loss-to-Lease Strategy: The "mark-to-market" strategy remains viable. A 6-unit townhouse complex in Cambridge recently sold for $250,000/unit. The asset was marketed with a potential 68% rental upside, attracting buyers willing to undertake the necessary unit turnover and renovation work.

- The "Turnkey" Premium: Small, fully renovated buildings are commanding top dollar. A pristine triplex in Kitchener recently traded for nearly $500,000 per unit, proving that investors will pay a premium for assets requiring zero immediate CapEx.

Transaction Velocity Trends

Activity surged significantly toward the end of the year. Our data indicates 11 confirmed multi-residential closings in December 2025 alone, compared to a steady monthly average of 3–4 transactions earlier in the year. This year-end velocity suggests that capital was eager to be deployed before the fiscal year closed, likely driven by stabilizing interest rates and clarity on financing costs.

Conclusion: Strategic Outlook

The Waterloo Region remains a dynamic environment for capital deployment. We are seeing a healthy ecosystem where institutional funds provide liquidity for large stabilized assets, while private investors continue to find yield in the 6–50 unit space through renovations and operational efficiencies.

For Owners and Investors: Pricing varies drastically based on unit mix, zoning potential, and utility metering status. Generic market averages are insufficient for accurate valuation in this climate.

If you require a specific valuation for your portfolio or are seeking off-market acquisition opportunities, please contact our team for a detailed analysis.

Sources: CMHC, StatsCan, Costar, RealTrack, MLS and various.